In the world of financial markets, certain chart patterns and formations play a significant role in guiding traders’ decisions. Among them, the rising wedge formation stands out for its ability to predict price reversals, particularly when combined with a contrarian mindset. One of the most interesting—and potentially lucrative—ways to exploit this pattern is by adopting the contrarian trading strategy of short selling rising wedge formations. But what exactly is this strategy, and how can traders harness its power for profit?

Introduction to the Contrarian Trading Strategy

In the realm of financial markets, traders generally fall into two categories: those who follow trends and those who go against the grain. Contrarian traders belong to the latter group, thriving on the idea that the majority is often wrong, particularly at market extremes. The contrarian trading strategy seeks to capitalize on this principle, identifying overbought or oversold conditions and positioning trades in the opposite direction of the prevailing trend.

Short selling rising wedge formations is a perfect fit for contrarians, as the strategy involves betting against an upward price movement that many traders would view as bullish. While most traders might see a rising wedge as a continuation of the current trend, contrarians interpret it as a precursor to a sharp reversal. The challenge is spotting the right conditions, timing your entry, and managing risk.

What Is a Rising Wedge Formation?

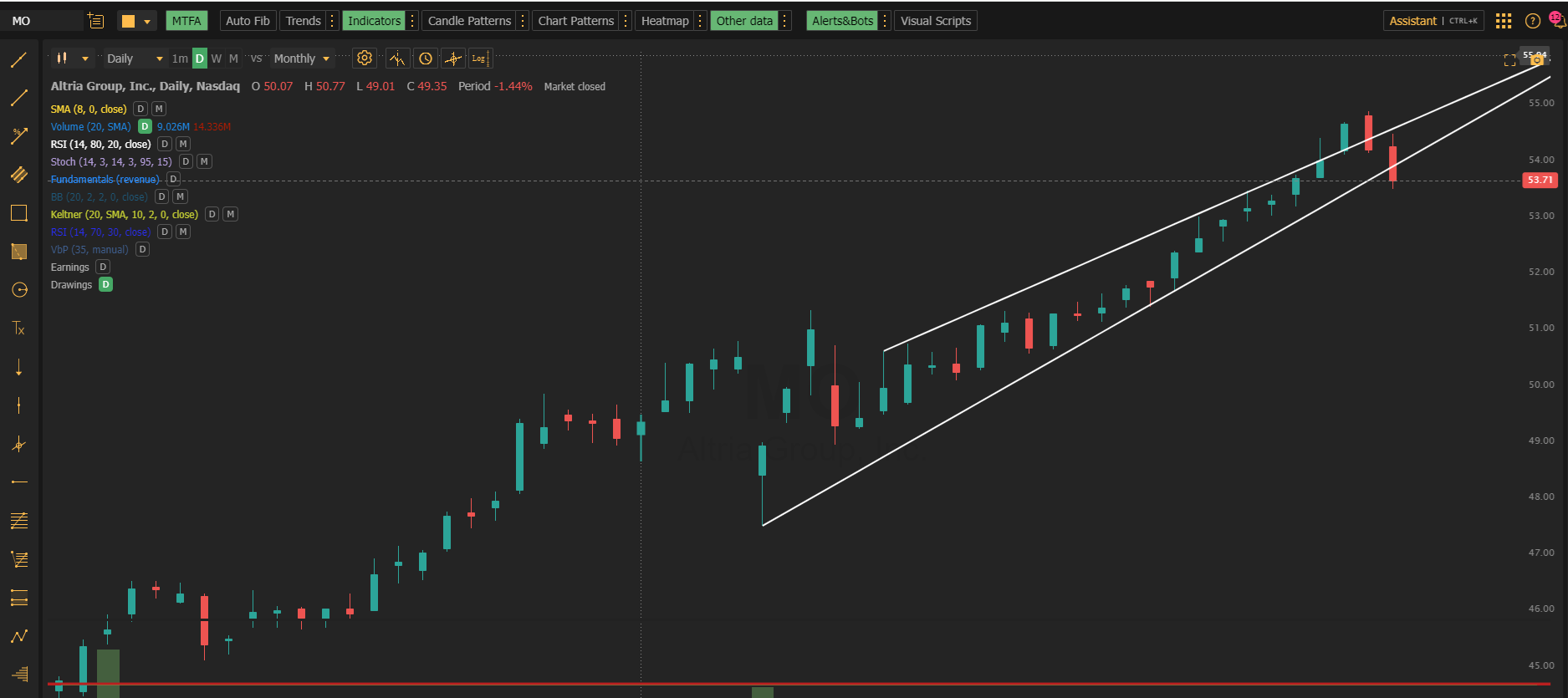

The rising wedge is a technical pattern that signals a potential reversal in price. It forms when an asset’s price creates higher highs and higher lows, but the rate of increase in the highs is slower than that of the lows. As a result, the trendlines connecting these highs and lows converge, forming a wedge shape on the chart.

A key characteristic of a rising wedge is that it appears in an uptrend and can often be misinterpreted as a sign of continued upward momentum. However, its real power lies in its ability to signal weakness in the trend, as buyers gradually lose strength and sellers start to take over.

How Rising Wedges Signal Reversals

Although the price of an asset might still be rising during the formation of a rising wedge, the contraction of the range indicates that bullish momentum is weakening. When the pattern reaches its apex, or point of convergence, a breakout is likely to occur. Contrary to what many might expect, this breakout is often to the downside, leading to a sharp reversal in price.

This is where contrarian traders spot an opportunity. As most traders continue to bet on further price increases, contrarians look for signs that the wedge is about to break downward and prepare to short sell.

The Mechanics of Short Selling

Short selling is a trading strategy that involves borrowing shares or assets and selling them with the expectation of buying them back at a lower price in the future. The difference between the selling price and the buying price is the trader’s profit. In the context of rising wedge formations, short selling comes into play once the price breaks downward, allowing traders to capitalize on the reversal.

For those unfamiliar with short selling, it’s important to understand that this strategy carries a higher level of risk than simply buying an asset. Since there is theoretically no limit to how high a price can rise, short sellers face the possibility of unlimited losses if the trade goes against them. Therefore, executing proper risk management and setting stop-loss orders is crucial in this type of trading.

Why Contrarians Target Rising Wedges

Contrarian traders have long recognized the potential in rising wedge patterns, particularly because they signal a change in market sentiment. Most investors see rising prices as an indication of strength, but in reality, a rising wedge reflects weakening momentum. Contrarians aim to capitalize on this false sense of security by betting against the trend just as it begins to reverse.

Moreover, rising wedges often occur in markets where optimism has reached a peak, and investors are buying based on fear of missing out (FOMO). Contrarians, on the other hand, adopt a more skeptical perspective, looking for signs that the rally is unsustainable and that a correction is imminent.

Key Steps to Short Selling Rising Wedge Patterns

When short selling a rising wedge formation, timing is everything. Here is a step-by-step guide to executing this strategy:

-

Identify the Pattern: First, locate a clear rising wedge on the chart. Look for a rising price with higher highs and higher lows that converge over time.

-

Wait for Confirmation: It’s crucial to wait for the price to break below the lower trendline before entering a short position. Prematurely shorting the wedge can result in losses if the breakout hasn’t yet occurred.

-

Set a Stop-Loss: To protect yourself against unexpected market movements, place a stop-loss above the upper trendline of the wedge. This limits your risk in case the breakout is to the upside.

-

Place Your Trade: Once the breakout occurs and the price closes below the lower trendline, enter your short position.

-

Manage the Trade: Monitor the trade closely and adjust your stop-loss as the price moves in your favor. Consider taking partial profits along the way, especially if the price approaches a key support level.

Entry Points for Short Selling

In trading, precise entry points can make or break a strategy. For contrarians shorting rising wedges, the best entry point is just after the price has broken below the lower support trendline. However, waiting for confirmation is crucial. A common mistake is to anticipate the breakdown too early, leading to potential losses if the asset’s price continues to rise.

A good practice is to wait for a daily close below the lower trendline or at least multiple confirmations from other technical indicators, such as a bearish crossover in moving averages or declining volume.

Stop-Loss Strategies in Short Selling

Stop-loss orders play a vital role in protecting your capital, particularly in short selling where losses can be unlimited. A safe approach for shorting rising wedges is to place your stop-loss slightly above the upper trendline of the wedge. If the price moves back into the wedge formation or breaks through the upper trendline, it’s a signal that the trade setup has failed, and exiting the trade is the prudent decision.

Additionally, trailing stop-losses can be useful in locking in profits as the price continues to decline. This allows traders to maximize their gains while minimizing the risk of a reversal.

Identifying False Breakouts in Rising Wedges

One of the biggest challenges in short selling rising wedge formations is the risk of a false breakout. A false breakout occurs when the price appears to break out of the wedge, only to quickly reverse and move back into the pattern.

To avoid falling into this trap, traders should use additional confirmation tools. For instance, waiting for a close below the trendline rather than a mere intraday move can help filter out false signals. Volume can also be a strong indicator: a true breakdown is often accompanied by increased selling volume, whereas a false breakout may occur on low volume.

Importance of Volume in Wedge Patterns

Volume plays a critical role in confirming the validity of a rising wedge pattern. In the case of a short trade, traders should look for increasing volume as the price approaches the wedge’s apex. This suggests that selling pressure is building and that a downside breakout is imminent.

Conversely, if the price breaks below the lower trendline but volume remains low, it could signal a lack of conviction in the move, making it more likely that the breakout will fail. Always use volume as a supporting factor in your analysis.

Combining Technical Indicators with Rising Wedges

While rising wedges are powerful patterns on their own, combining them with other technical indicators can greatly enhance the reliability of your trade setup. Indicators such as the Relative Strength Index (RSI), moving averages, or the MACD (Moving Average Convergence Divergence) can provide additional confirmation of a weakening trend.

For example, if a rising wedge forms while the RSI is in overbought territory, it strengthens the case for a reversal. Similarly, if the MACD shows a bearish crossover during the formation of the wedge, it further supports the decision to short sell.

Learn more abut wedge formations and much more at our resource library